Maryland

What is the Homeowners' Property Tax Credit Program?

The State of Maryland has developed a program which allows credits against the homeowner's property tax bill if the property taxes exceed a fixed percentage of the person's gross income.

In other words, it sets a limit on the amount of property taxes any homeowner must pay based upon his or her income.

This credit has a household income cap of $60,000. For purposes of the credit, income has a broad definition that includes items that are otherwise not taxable.

This plan has been in existence since 1975 when it was known as the "circuit breaker" plan for elderly homeowners. The plan was called circuit breaker because it shut off the property tax bill at a certain point just like an electric circuit breaker shuts off the current when the circuit becomes overloaded.

The Maryland General Assembly has improved the plan through the years so that now this program is available to all homeowners regardless of their age, and the credits are given where needed based upon the person's income.

How Is "Income" Defined?

For purposes of the tax credit program, it is emphasized that applicants must report total income, which means the combined gross income before any deductions are taken. Income information must be reported for the homeowner and spouse and all other occupants of the household unless they are dependents or they are paying rent or room and board.

Income from all sources must be reported whether or not the monies received are included as income for Federal and State income tax purposes.

Nontaxable retirement benefits such as Social Security and Railroad Retirement must be reported as income for the tax credit program. Generally, eligibility for the tax credit will be based upon all monies received in the applicant's household in a given year.

What Are The Other Requirements?

Before your eligibility according to income can be considered, you must meet four basic requirements.

- You must own or have a legal interest in the property.

- The dwelling on which you are seeking the tax credit must be your principal residence where you live at least six months of the year, including July 1, unless you are a recent home purchaser or unless you are unable to do so because of your health or need of special care.

- Your net worth, not including the value of the property on which you are seeking the credit or any qualified retirement savings or Individual Retirement Accounts, must be less than $200,000.

- Your combined gross household income cannot exceed $60,000.

How Is The Credit Figured?

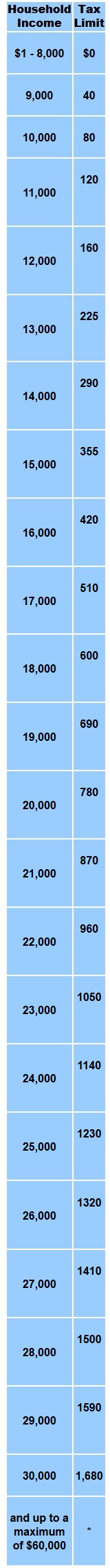

The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula: 0% of the first $8,000 of the combined household income; 4% of the next $4,000 of income; 6.5% of the next $4,000 of income; and 9% of all income above $16,000.

Using the new higher benefit formula enacted by the 2006 session of the General Assembly, the chart below is printed in $1,000 increments to show you the specific tax limit for each income level.

* For each additional $1,000 of income above $30,000, you add $90 to $1,680 to find the tax limit. Your combined gross household income cannot exceed $60,000.

Example: If your combined household income is $16,000, you see from the chart that your tax limit is $420. You would be entitled to receive a credit for any taxes above the $420. If your actual property tax bill was $990, you would receive a tax credit in the amount of $570 --- this being the difference between the actual tax bill and the tax limit.

What Other Limitations?

- Only the taxes resulting from the first $300,000 of assessed valuation.

- The credit applies to the ad valorem taxes imposed by the state, county and municipalities, but it does not cover any metropolitan or fixed charges for water and sewer services that may appear on the tax bill.

- If an applicant owns a large tract of land, the credit will be limited to the lot or curtilage on which the dwelling stands and will not include the excess acreage.

- If a portion of your dwelling is used for commercial or business purposes, the credit will be based only upon the taxes for that portion of the dwelling occupied by your own household.

- You may apply for the credit on only the one dwelling which is your principal residence.

How Does One Receive The Credit?

Homeowners who file and qualify by May 1 will receive the credit directly on their tax bill or as a credit certificate issued at the same time the property tax bill is mailed.

Persons who file later up until the September 1 deadline will receive any credit due either in the form of a revised tax bill or a tax credit certificate to be used in payment of the bill. Applicants filing after May 1 are advised not to delay payment of the property tax bill until receipt of the credit if they wish to receive the discount for early payment offered in some subdivisions.

A refund check will be issued by the local government if the tax bill was paid before the tax credit was granted.

What Happens If One Is Not Eligible?

Whenever homeowners are found not qualified to receive a tax credit, they are informed in writing. The letter gives the reason for denial and what steps to take if further questions remain. The letter also explains how homeowners can appeal the determination of ineligibility to the local Property Tax Assessments Appeals Board.

When and How Do You Apply?

The Homeowners' Tax Credit is not automatically granted and each person must apply and disclose his or her income. You must apply every year by no later than September 1 on a standard application supplied by the Department of Assessments and Taxation. However, it is to your advantage to submit the application by May 1 so that any credit due you can be deducted beforehand from the initial July tax bill.

We have forms for your convenience AND we will complete the form for you, if you wish.

An application is routinely sent to homeowners who were recipients of a tax credit in the previous year. Applications are available as of February each year at the local assessment offices and at most public libraries, or by calling the Tax Credits Telephone Service at 410-767-4433 (Baltimore Area) or 1-800-944-7403 (Toll Free). The form can be downloaded at the SDAT website.

Once completed, applications should be mailed to:

State Department of Assessments & Taxation

Homeowners' Tax Credit Program

301 W. Preston Street, Room 900

Baltimore, Md. 21201-2395

Your Application Is Confidential

Persons filing for the Homeowners' Tax Credit Program are required to submit copies of their prior year's federal income tax returns and to provide the Department with permission to verify the amount of income reported with other State and Federal agencies.

The sole purpose for which this information is sought is to determine your eligibility for a tax credit. All income-related information supplied by the homeowner on the application form is held with the strictest confidentiality.

It is unlawful for any officer or employee of the State or any political subdivision to divulge any particulars set forth in the application or any tax return filed, except in accordance with judicial or legislative order.

This information is available to officers of the State in their official capacity and to taxing officials of any state, territory, or the federal government, as provided by statute.

Prospective Home Buyers

A law enacted by the 2000 session of the General Assembly allows low and moderate income home purchasers to apply in advance for the Homeowners' Tax Credit before acquiring title to the property.

The purpose of this program is to help reduce the amount of monies needed at the time of settlement. You must apply at least 30 days before your expected settlement date to receive any credit due at the time of settlement. For more information, call the Tax Credit Telephone Service and request Form HTC-NP.